student loan debt relief tax credit virginia

Administered by the Maryland Higher Education Commission MHEC the credit provides a refundable tax credit cash payment that a tax filer applies directly to their student loan balance. Pay off your credit card balance.

New Options For Student Loan Forgiveness

The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents.

. Choose Your Debt Amount 20000 Call Today. If you live in Virginia and need help paying off your credit card debt InCharge can help you. If you have an outstanding balance on more than one credit card try to pay off the.

Use these tips to get the most value from your refund check. Provide partial debt cancellation for each borrower with household gross income between 100001 and. Top Student Loan Forgiveness Programs.

About the Company 2021 Tax Relief Department Of Taxation In Virginia. Virginia Tax Credits Review the credits below to see what you may be able to deduct from the tax you owe. Debt Relief Credit Repair Insurance Get your free credit score in minutes.

Failure to do so will result in recapture of the tax credit back to the State. 800 565-8953 or Continue Online. Currently we see the following.

LoginSign Up for Free Call Us 1-800-813-4620 Debt Relief How Does LendingTree Get Paid. A tax refund provides the opportunity to improve your financial situation. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

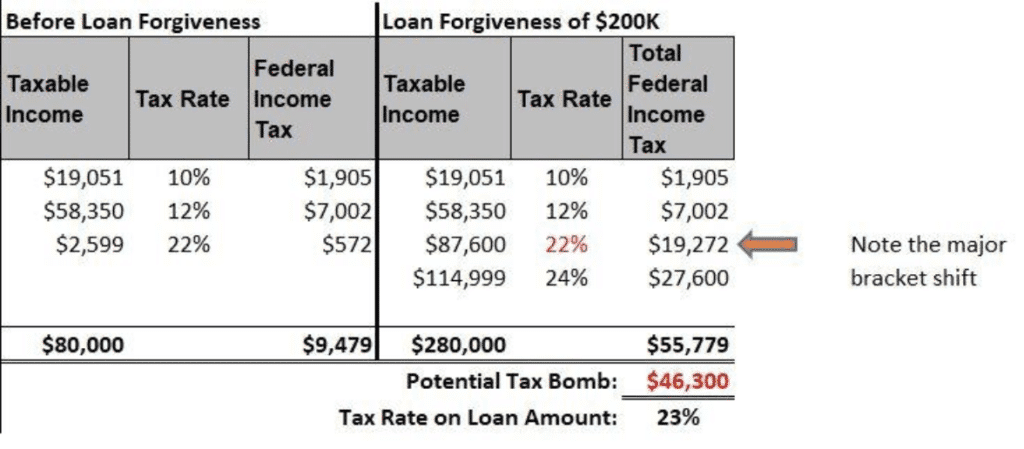

Virginia Foxx has criticized Bidens plans to. In some states the discharge of debt is considered taxable income. It was established in 2000 and is a part of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators.

Virginia Debt Relief Programs and Resources InCharge provides free nonprofit credit counseling and debt management programs to Virginia residents. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor. A top Republican slams Bidens latest student-loan relief saying he operates as if he can issue any decree he wants on debt forgiveness.

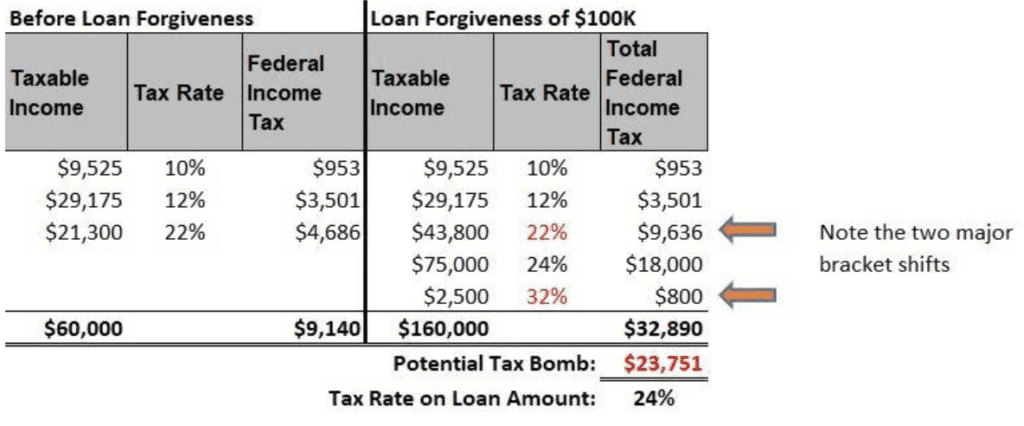

For example if you have 10000 in student loans forgiven that amount gets added to your income and you pay tax on the result. Recipients of the tax credit must submit proof that they used the tax credit to pay down qualifying student loans. Skip The Bank Save.

Ad Loan Refinancing Can Saves You Thousands of Dollars by Replacing Existing College Debt. The application period is July 1 to September 22 of. Use Our Comparison Site Find Out Which Lender Suites You The Best.

1 day agoAt the end of the day we have to recognize that 10000 is not enough Wisdom Cole the national director of the NAACP Youth College. June 5 2022 at 108 pm. Virginia College Closed Locations are.

Ad Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. In 2019 the state awarded nearly 9 million in tax. If you are awarded this credit you may receive up to 5000.

If the credit is more than the taxes owed they will receive a tax refund for the difference. The Department of Education estimates that 36 million borrowers will be three years closer to receiving loan forgiveness through the IDR program and thousands will be eligible for forgiveness. Cancel up to 50000 in student loan debt for borrowers with 100000 or less in household gross income.

11 states with no state income tax so loan forgiveness is tax-free. About the Company Virginia Student Loan Debt Relief Tax Credit CuraDebt is a company that provides debt relief from Hollywood Florida. So if you apply in 2021 to receive the credit for the 2020 tax year youll know if and how much youve been awarded by December 15th of 2021.

2 days agoBiden open to canceling 10000 in student loans per borrower what that means for your budget credit score and tax bill Last Updated. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. On the campaign trail he proposed canceling a minimum of 10000 in student debt per person as a response to the pandemic as well as forgiving all undergraduate tuition-related federal student.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an accredited college or university. You can find a great list of Federal student loan forgiveness programs here.

Use your refund for some much needed debt relief. Student Loan Debt Relief Act legislation to cancel student loan debt for 42 million Americans. If you are a former Virginia College student you may not even have to pay back your student loan here are some options you have.

The State of Maryland will inform you of the award by December 15th of the year you apply. PAY DOWN YOUR DEBT. It was founded in 2000 and has been a participant in the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators.

However residents of the State of Virginia can also potentially qualify for various Federal student loan forgiveness programs. On December 13 2018 the Department of Education announced it would be wiping 150 million in student loans for 15000 borrowers whose schools closed on or after Nov. Virginia has several student loan forgiveness programs that are specific to just the State of Virginia.

Of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan debt and provide proof of payment to MHEC. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. How much is the Student Loan Debt Relief Tax Credit.

You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program. Individual income tax Corporate state income tax Bank franchise tax Insurance premiums license tax Tax on public service corporations. Tax credits under the program are equal to 65 percent of the value of the monetary or marketable securities donation and may be claimed against the following state taxes.

Maryland offers the Student Loan Debt Relief Tax Credit for students who have incurred at least 20000 in student loan debt and have a remaining balance of at least 5000.

Student Loan Forgiveness New Study Shows Who Benefits Most Money

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Student Loan Forgiveness Programs The Complete List 2022 Update

Learn How The Student Loan Interest Deduction Works

Virginia Student Loan Forgiveness Programs

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loans May Qualify For Federal Forgiveness

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Virginia Ag Miyares Secures Student Debt Relief From Defunct For Profit College Wavy Com

Governor Hogan Announces 9 Million In Additional Tax Credits For Student Loan Debt Wdvm25 Dcw50 Washington Dc

Texas Debt Relief Programs Get Nonprofit Help For 2k 100k

Who Owes The Most Student Loan Debt

Biden Administration Resists Democrats Pleas On Student Debt Relief As Deadline Nears Virginia Mercury

Biden Has Forgiven 9 5 Billion In Student Loan Debt Money

Virginia College Loan Forgiveness Options Debt Strategists